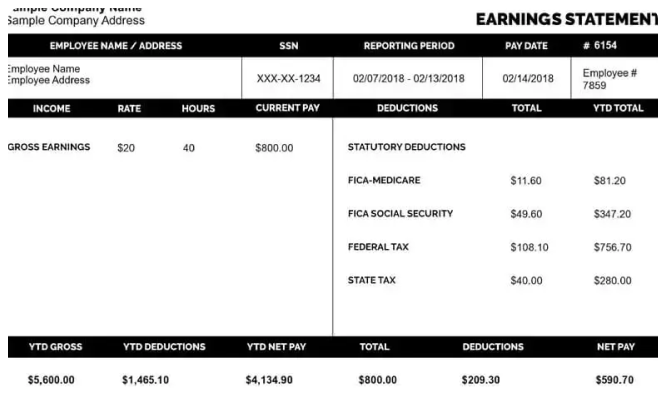

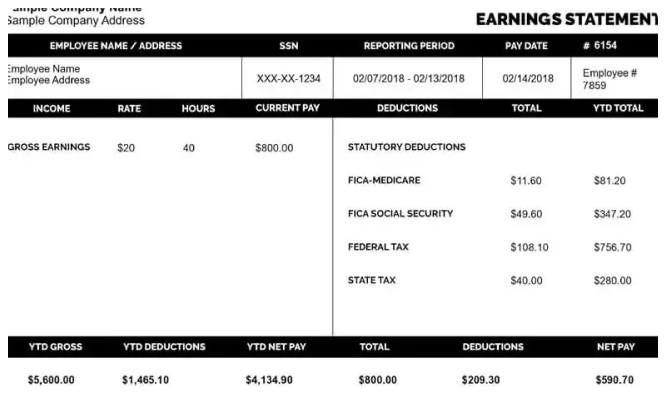

How to Use a Pay Stub Sample Template for Accurate Payroll Records

Managing payroll efficiently is essential for businesses of all sizes, from small business owners to freelancers. Keeping accurate payroll records ensures compliance with tax regulations, helps track earnings, and provides employees with clear documentation of their wages. One of the simplest ways to streamline payroll management is by using a pay stub sample template.

In this article, we’ll […]